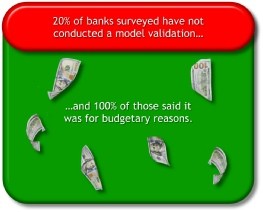

Introduction The heart and soul of your program is your BSA (Bank Secret Act)/AML This article will define what an AML model validation is and it’s importance. We will also delve into our top ten findings of AML model validations and ways to avoid them. What is an AML Model Validation? An […]